Cathie Wood Goes Shopping: 3 Stocks She Just Bought

Cathie Wood bought shares of Taiwan Semiconductor, Oklo, and Pony AI on Friday. Growth is slowing at TSMC, but its high-margin business model deserves a market premium.

OKLO - Oklo Inc.

OKLO - Oklo Inc.

Cathie Wood bought shares of Taiwan Semiconductor, Oklo, and Pony AI on Friday. Growth is slowing at TSMC, but its high-margin business model deserves a market premium.

Oklo stock pulled back about 10% after a sharp META-fueled rally. Here is what the volatility, valuation, and long-term outlook mean for investors in 2026.

Some of the market's most volatile stocks have seen significant insider selling recently. This includes notable names across rare earth metals, nuclear energy, and aerospace industries.

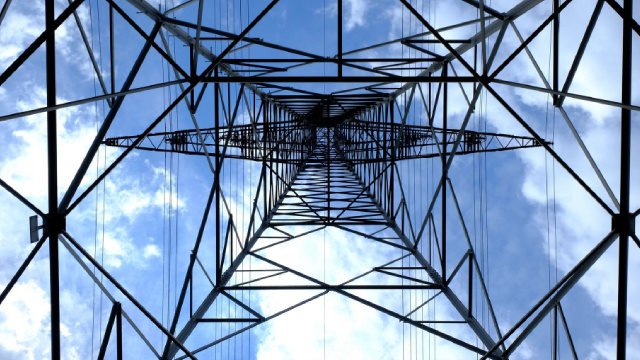

Oklo (OKLO +3.64%) is emerging as a bold nuclear energy play tied directly to AI data center demand. Government backing and massive upside potential collide with execution and regulatory risk.

Nuclear stocks were some of the biggest winners over the past year as investors are starting to notice their role in the AI bottleneck.

This AI-framed energy stock has climbed over 270% in the last year.

Oklo offers strong nuclear ambitions and capital reserves, but shares now trade at an excessive premium relative to medium-term fundamentals. OKLO's business model integrates construction,...

Oklo's NYSE: OKLO deal with Meta Platforms NASDAQ: META is well-liked by the market. Yet another partnership with a major datacenter operator not only affirms the energy technology but also...

Oklo stock moved lower today in response to bearish momentum for the broader market. The company's pullback actually looks relatively modest given declines for major indexes.

Oklo stock soared last week on news of a deal with Meta Platforms. Shares of Oklo closed lower on Monday and Tuesday.

Nuclear startup Oklo signed a huge deal to build new power plants to help Meta Platforms meet surging demand for artificial intelligence. But Chief Executive Officer Jacob DeWitte says more...

Artificial Intelligence (AI) has hit a physical wall. For the last decade, the primary constraint on technology growth was computing power, or how many chips a company could buy.

Oklo (OKLO 5.45%) is a pre-revenue nuclear energy stock that investors believe could power AI data centers and national security. The upside is massive, but everything depends on regulatory...

Citizens Financial Group Inc. RI lowered its position in Oklo Inc. (NYSE: OKLO) by 57.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and...

Canal Insurance CO trimmed its position in Oklo Inc. (NYSE: OKLO) by 50.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The...

Access to energy is one of the biggest bottlenecks to the AI race. Big Tech companies have been on an energy-related hiring spree as they get to grips with the market.

Oklo Inc. (NYSE: OKLO - Get Free Report) dropped 2.7% on Monday following insider selling activity. The stock traded as low as $100.37 and last traded at $102.47. Approximately 11,943,273 shares...

Oklo's Meta news helped drive Oklo stock up 35% last week. It's giving back some gains today as investors take profits.

Oklo co-founder and CEO Jacob Dewitte joins 'Money Movers' to discuss the company's nuclear agreement with Meta, the development of a nuclear power campus in Ohio, and more.

Investors have rushed to buy the dip in Oklo stock as the company continues to secure major deals. Oklo's multi-billion dollar deal with Meta and its latest DOE contract are both significant milestones.